refinance my existing loans

How switching could save you

According to research, an estimated eight million Australians are being hit by a “loyalty tax” and paying more for financial products than necessary by sticking with the same provider – particularly when it comes to home loans. Why? Well for one, it’s very easy to “set and forget” your home loan. It’s also easy to think that you’ll be rewarded for your loyalty. But whilst your lender may have presented you with a great offer initially, it’s unlikely that they will call to offer you a better deal 1, 5 or even 20 years down the track. With the majority of lenders offering their best deals to new customers, it pays to shop around.

In fact, The Finder Loyalty Tax Report estimates Australians could be saving up to $8,496 across four common financial products –mortgage, savings, health insurance and credit cards – if they’d switch providers. Refinancing can often seem stressful and arduous, however, at Sanford Finance, we make it easy for our clients by handling the refinancing process for them; negotiating rates, speaking to different lenders, looking at your financial situation and then presenting the best options for you.

Potential savings as reported in The Finder Loyalty Tax Report

- Credit cards. $253 saved if transferring the average interest-accruing credit card balance to a 0% balance transfer card.

- Home loans. $6,826 saved per year by moving from the average home loan variable rate across the Big Four banks to the lowest rates on the market.

- Health insurance. $635 per year potential saving between the highest and lowest priced policies on the same coverage tier.

- Savings. $2,346 potential interest earned over three years when switching from the average online savings rate to one of the three banks offering the highest rates on the market, based on the average saving volume in

Australia (for further details, see the savings section).

Home Loans

The Finder Loyalty Tax Report found that the average Australian mortgage holder has been with the same home loan provider for 7.2 years. As this data was taken between May 2019 and January 2020, this means that these mortgage holders stayed with the same lender despite three consecutive cash rate drops in 2019 and the RBA slashing cash rates by 75 basis points¹ between June and October and many lenders not passing on those rate drops in full.

The report found that the average owner-occupier home loan in Australia stands at $494,414 Switching from the average variable home-loan rate of 4.55%² to one of the lowest in the market (2.49%³) could save borrowers a whopping $6,826 per year or $204,793 over the full 30-year life of the loan.

Finder also found that only 3% of Aussies switched home loans during that time for a better deal, despite 1 in 3 adults (33%) surveyed saying that paying their home loan causes them stress and 43% of borrowers feeling that they aren’t getting good value from their home loan.

Concerningly, the report found that 51% of Australians surveyed didn’t even know what their home loan interest was – meaning there could be 3.4 million mortgage payers who could be paying too much for their loan.

Case Study

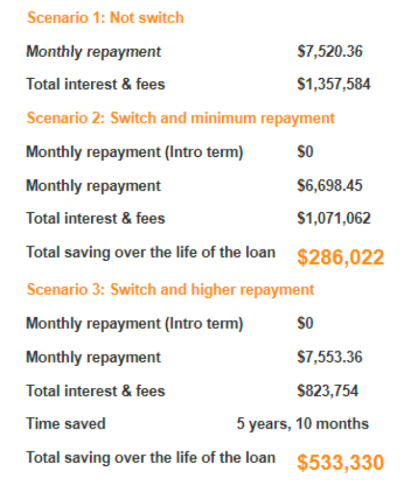

One of our clients recently switched after 12 months with their existing lender. With Sanford Finance handling all of the negotiation and transfers, the client was able to benefit from the reduced monthly repayment and overall savings without any additional stress.

We presented our client with two options, allowing them to choose the option that best suited their lifestyle.

The first provided a lower monthly repayment, saving $821.91 on monthly repayments and an overall saving of $286,022 over the life of the loan.

The second option would see the client paying $33 more per month, however, saving $533,330 over the life of their loan and paying their loan 5 years and 10 months sooner than they would have with their original lender

Conclusion

74% of Aussies stress about their finances

It’s no secret that managing household finances is stressful – especially with the cost of living rising.

At Sanford Finance we work for you, not the banks. Over the years we’ve helped hundreds of Australian families save money on their loans.

As an independent mortgage broker, we have access to a wider range of loans than other lenders, allowing us to find and negotiate a better rate and secure lending that is right for your needs – not the banks. Refinancing, or switching home loans, can save you thousands.

Some of the benefits of refinancing include:

- Change your type of loan (fixed or variable).

- Get access to new home loan features.

- Introducing redraw options to access cash in a hurry.

- Adding lump sum payment options to pay off your loan faster.

Refinancing your loan doesn’t need to be a hassle. Get in touch with the team at Sanford Finance to see how we can help.

Call us today at 02 9095 6888 or Book a free consultation with one of our expert brokers to explore your savings options

The Finder Loyalty Tax Report estimates Australians could be saving up to $8,496 across four common financial products. Download Report Here