With talk of rate increases, we’re hearing from more and more clients who are looking to

secure a fixed rate loan – but is it too late?

Unfortunately for the most part, the answer is yes.

At this point, most fixed-rate loans have already factored in any future rate increases, but

that is not to say that a fixed rate loan shouldn’t be considered.

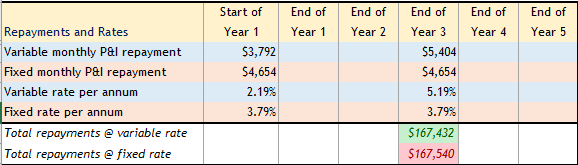

Over the years, variable rates have typically outperformed fixed rates, as you can see with

the below $1,000,000 loan example:

Example Loan Scenario:

| Loan Amount | $1,000,000 |

| Total loan term (years) | 30 |

| Variable rate per annum | 2.19% |

| Assumed quarterly rate increase | 0.25% |

| Fixed rate per annum | 3.79% |

| Fixed rate term (years) | 3 |

Conclusion: The variable repayments will increase from $3,792 to $5,404 per month, superseding the fixed repayments of $4,654 p/m mid-way through year two of the fixed term.

Who should take out a fixed rate loan?

Whilst a variable rate loan may currently seem like the better option, that isn’t the case for

everyone.

There are numerous reasons that a fixed rate loan may be the better option for you,

however, the main one is cashflow security.

By locking in your rates, you know that your monthly repayments will not increase,

decreasing your risk of hardship if the repayments rise above a certain level.

In the above example, the variable repayments will increase from $5,350 to $12,850 per

month, superseding the fixed repayments of $9,475 p/m mid-way through the fixed term.

For many borrowers, a fixed rate loan provides peace of mind, knowing that you can

continue to afford your repayments for the length of the fixed term.

Is a fixed loan rate right for me?

The answer to that depends on your personal circumstances – but we’re here to help.

Whether you’re looking to refinance or take out your first loan, our team will guide you

through the process, taking into account your income, lifestyle, future goals and presenting

you with the best options for your needs.

Contact us today on [email protected] or (02) 9095 6888