What is a Bridging Loan and When Should You Use It?

Finding your dream home when you haven’t yet sold your previous home can be stressful – but that’s where bridging finance can help.

What is a Bridging Loan?

A bridging loan (or bridging finance) is short-term loan, generally lasting for up to 12 months or until the sale of your old property.

The idea is that the loan creates a financial “bridge”, allowing homeowners to purchase a property before selling their previous one – but there are many aspects to this style of loan that should be considered before signing.

How does a bridging loan work?

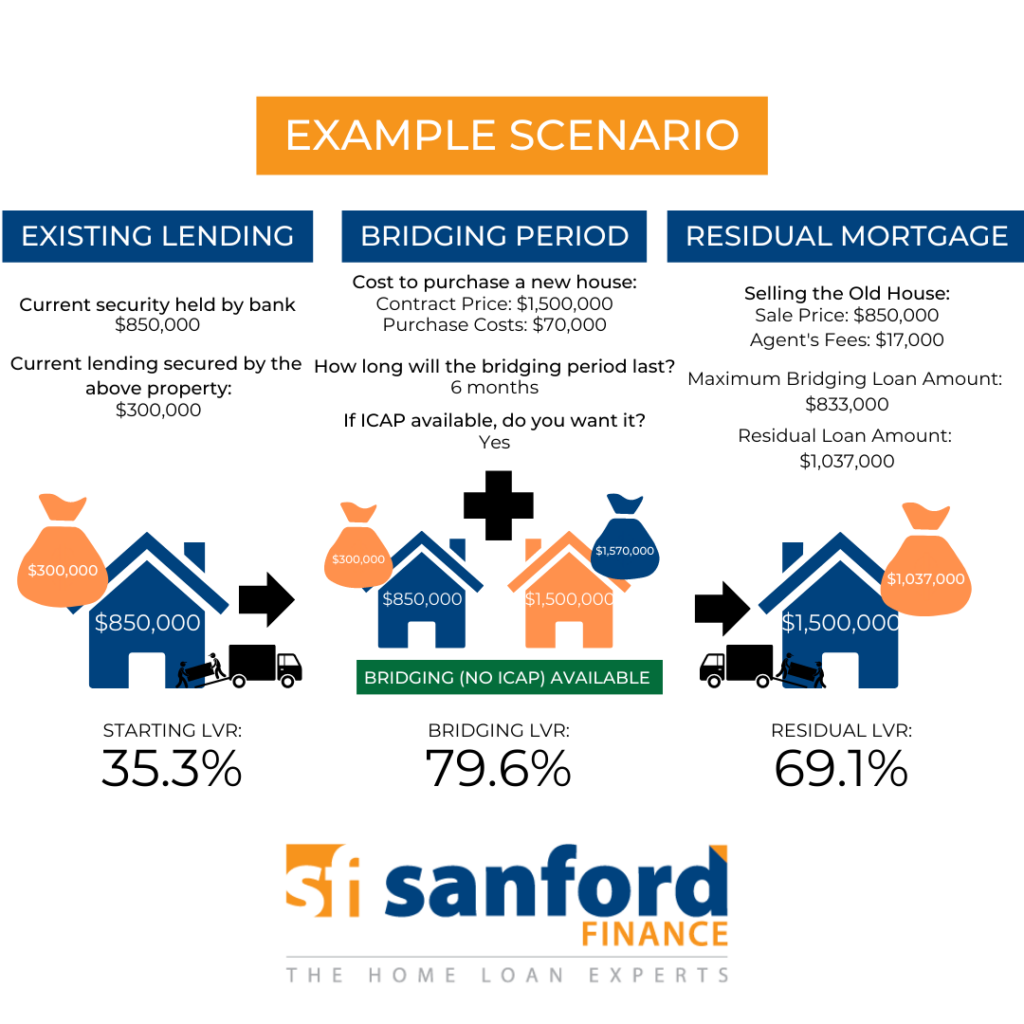

Here is a quick example to show you how the process may work

What are the benefits of a bridging loan?

- Fast Approval

Bridging loans are typically approved quickly, often within a few days, allowing you to secure your dream home faster.

- Convenient

A bridging loan allows you to look for and purchase a property without having to wait for your current home to sell. This means you could purchase the dream home you find unexpectedly – or secure a place to live without having to worry about renting between selling and purchasing etc.

- Flexible Repayments

The structure of your loan can vary, however, bridging loans typically offer flexible repayment terms, including interest-only repayments, lump sum repayments or the option to repay the loan once your old property has sold.

- No Need for Temporary Accommodation

If the timing is right with your bridging loan and your sale/purchase, it’s possible to avoid the cost and hassle of having to rent a home, living with friends or relatives or negotiating a longer (or shorter) settlement period to ensure you have somewhere to live.

- Avoid Property Chains

Bridging loans can help you avoid property chains, which can be complex and time-consuming, allowing you to move into your new home faster.

- Flexibility

Bridging loans provide flexibility and can be tailored to your unique financial situation, giving you peace of mind knowing that you have the financial support you need to purchase your dream home.

What are the downsides of a bridging loan?

- Time limits12 months can go by very quickly and a time limit may mean you have to sell your old property at a lower than expected price just to get the sale finalised. If you don’t sell your home in the required time, you could be left with a large interest bill or risk the bank stepping in to sell your property.

- The selling price risk

Speaking of lower selling prices, if your property sells for less than expected you may be left with a larger ongoing loan amount – increasing repayments, interest etc and potentially causing financial difficulty.

- Additional Costs

Bridging finance may require two property valuations (your existing and new property) which could mean two valuation fees, as well as other fees and charges that come with the loan.

- Termination Fees

If your current lender doesn’t offer a bridging loan, you’ll need to switch to a lender who does offer these loans – potentially resulting in early exit fees from your current loan.

- Interest and Interest Rates

Interest is usually charged on a monthly basis, so the longer it takes to sell your property, the more interest your new loan will accrue. If you don’t sell your home within the bridging period, you will also typically be charged a higher rate.

How do I know if a bridging loan is right for me?

As everyone’s financial situation is different, it’s important to speak to a professional and do your own research before deciding if a bridging loan is right for you. At Sanford Finance, we’ll work with you to determine the right options for your unique financial situation – finding the right loan options, ensuring you are looking for properties you can afford and walking you from the first steps through to settlement and even refinancing in the future to ensure you always have the right loan for your needs.