Stamp Duty Choice: Which is the better way to pay?

New South Wales Premier, Dominic Perrottet has revealed that the state will be giving eligible first home buyersd the option of paying stamp duty upfront or an annual property tax (based on the ‘dutiable value’ of the property) from January 16th 2023, but which choice is the right choice?

The answer really depends on your circumstances – and your property may not even be eligible.

This property tax option will be available for properties valued up to $1.5 million. To be eligible, you must move into the property within 12 months of purchase and live in it continuously for a minimum of 6 months.

Under the new scheme, first home buyers who opt for the property tax will pay an annual property tax plus a percentage of the land value of the property.

What will the property tax rates be?

The property tax rates for 2022-23 will be:

- $400 plus 0.3 percent of land value for properties whose owners live in them;

- $1,500 plus 1.1 percent of land value for investment properties

These rates will be indexed each year and will rise in line with average incomes.

A property tax calculator will be available after the enactment of legislation and before January 16th 2023 when buyers can opt-in to property tax.

What about first home buyer exemptions?

First home buyers will continue to be eligible to apply for full stamp duty exemption for properties up to $650,000, with concessions also remaining in place for properties between $650,000 and $800,000.

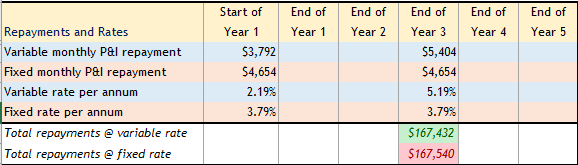

How do the options compare?

Let’s run through an example.

First home purchase: $1,200,000

Stamp duty on purchase: $50,875

2022-23 property tax: $2,560 – Based on Assessable Duty of $750,000 (ie. land value)

With half of all owner-occupier selling their property within 10 years, not paying stamp duty would help to lower the up-front costs of purchasing a property, however, for an owner who is planning on staying in their property long term, a once-off stamp duty purchase may be a better option – and there would be no need to budget for that yearly repayment.

What is the purpose of the stamp duty scheme?

This new scheme is part of a multi-billion dollar housing package that was announced in the 2022-23 NSW budget, aiming to deliver “quality, accessible and affordable housing” across the state.

The Premier hopes that the option of stamp duty or annual tax would help a broader group to become first home buyers, suggesting that stamp duty adds about two years to the time required to save the up-front costs of the median NSW dwelling (based on a NSW household with the median income saving 15 per cent of their income).

Looking to purchase your first home?

Get in touch with us to make sure you have everything sorted before heading to that first open home. From purchase prices to pre-approval, we’re here to help make the purchasing process as smooth as possible.