Are you considering purchasing property through a Self-Managed Super Fund?

Purchasing property through a self-managed super fund (SMSF) can be a smart investment strategy for Australians looking to secure their retirement future – but it’s important to know what you’re doing.

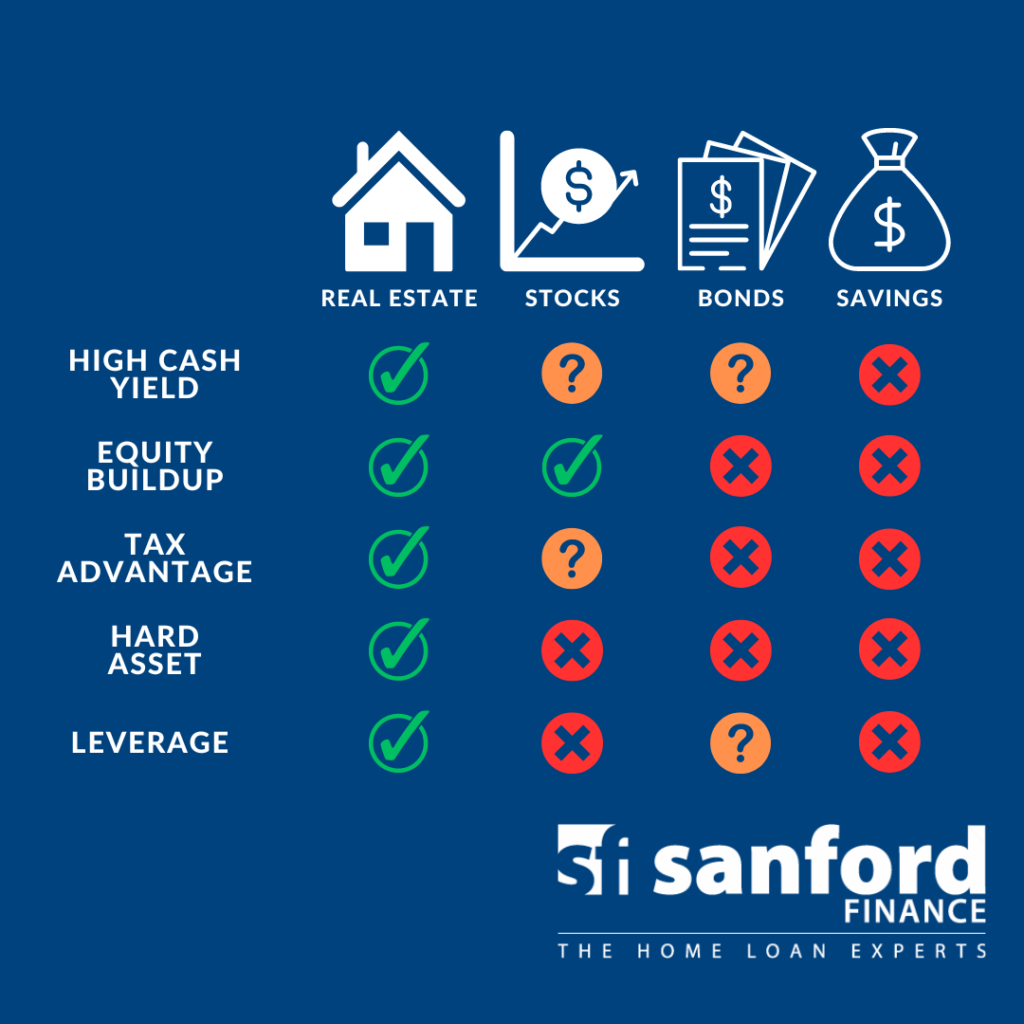

With the Australian property market experiencing consistent growth over the years, buying property through an SMSF can provide a range of financial benefits.

What are the benefits of purchasing property through a self-managed super fund?

One of the main advantages of purchasing property through an SMSF is the potential tax benefits. Income from rental properties held by an SMSF is generally taxed at a rate of only 15%, compared to the marginal tax rate that applies to individuals. This means that the rental income earned from an SMSF-owned property is taxed at a much lower rate, leaving more funds available for reinvestment or retirement income.

Other benefits of investing in property through a self managed super fund include:

- Leveraging your investment by borrowing through limited recourse borrowing arrangements (LRBA)

When investing in property through an SMSF, investors can leveraging their investment by borrowing money through limited recourse borrowing arrangements (LRBAs). This allows investors to purchase property with a smaller initial investment and to benefit from any capital growth over time. - Increased control over investments

SMSF trustees can also benefit from increased control over their investments. Unlike traditional superannuation funds, SMSF trustees have direct control over the investment strategy and can make investment decisions in line with their specific goals and risk appetite. This level of control and flexibility can be particularly attractive to investors who want to take a more active role in managing their retirement savings.

What are the downsides of purchasing property through a self-managed super fund?

It’s important to note that investing in property through a self-managed super fund Is not without risks, including:

- Fluctuating property values

- The time and money involved in managing a property

- The stress of dealing with leasing your property/choosing the right tenants/potential damage to property

With this in mind, it’s crucial that investors undertake thorough research and seek professional advice before making any investment decisions.

Is purchasing property through a SMSF right for me?

Overall, purchasing property through a self-managed super fund can be a sound investment strategy for those looking to diversify their portfolio, enjoy tax benefits and take greater control over their retirement savings. With the Australian property market showing consistent growth, SMSF trustees may find that investing in property is a smart move for their financial future.

If you’re interested in exploring your options and finding out more, get in touch! Sanford Finance has helped many clients secure property through their Self-Managed Super Funds as well as helped numerous clients with their general investment portfolios. We’ll work through the different options with you and find out which is best suited to your financial goals.

Get in touch with our team at www.sanfordfinance.com.au/contact or call us on 9095 6888