Evaluating the property market in Australia: Is now the time to buy or sell?

The decision to buy or sell property is always a tricky one, as it’s a significant financial step that involves careful consideration of various factors – including market conditions.

Whilst it’s important to know that real estate markets can be unpredictable, understanding the key indicators can help you to make an informed decision. So, let’s look at the factors influencing the Australian property market.

- Low Listing Numbers = Increased Competition for Buyers

With decade-low listing numbers, there’s not a lot of competition in the market for vendors – but competition is fierce for buyers as they battle it out to secure a property. This is one of the reasons that selling conditions have strengthened, as evidenced by above average clearance rates, faster selling time and less negotiation.

The total number of homes listed for sale across Australia is currently 28% below usual (as reported by CoreLogic). When these volumes are low, selling conditions strengthen, meaning that potential vendors thinking about selling may jump in now rather than waiting until the traditional spring period where activity surges and there’s a spike in competition.

- Rising Prices

Home values for Sydney, Melbourne, Brisbane and Perth all recorded an increase in housing values from the lows recorded in February. A mid-month update based on CoreLogic Australia’s daily Home Value Index showed the upswing gathering momentum, especially in cities such as Brisbane where the index is up 1.0% over the past four weeks whilst the Sydney property market still remains the strongest.. Considering housing affordability measures remain stretched such a strong rate of growth is surprising, with many experts predicting that this price rise will not be sustainable in the long term.

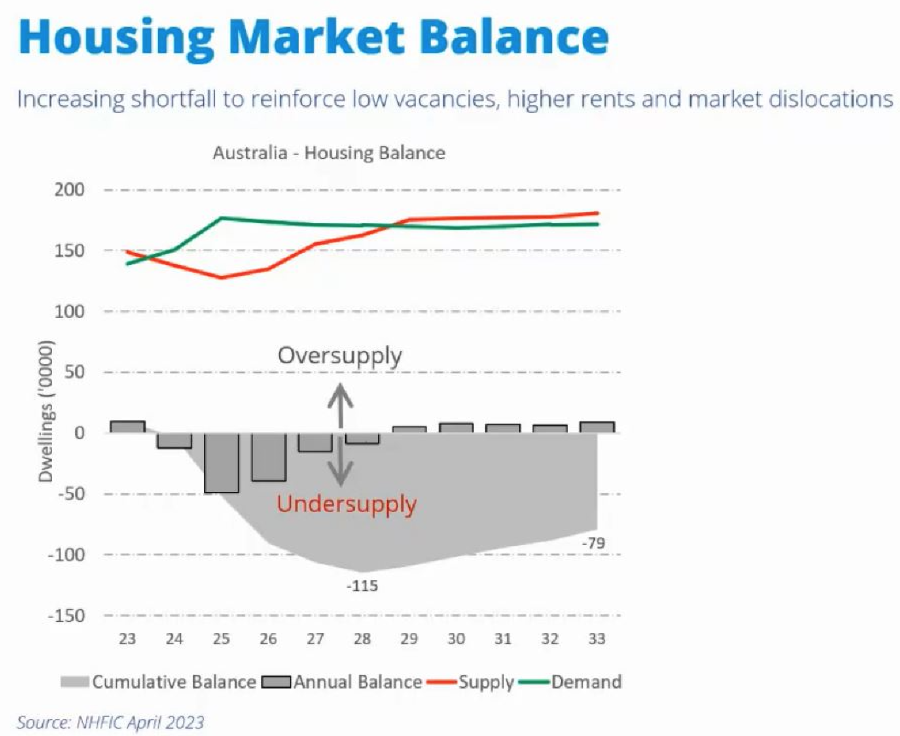

- Low Supply vs High Demand

As mentioned above, decade-low listing numbers and high demand has lead to fierce competition between buyers – as seen in auction clearance rates that have been holding at 70% or higher in recent weeks.

In a time where the market traditionally tends to cool off, the stats suggest that, if anything, the market is gathering momentum instead of slowing down. Strong clearance rates as well as faster selling times and reduced discounting rates indicate that it’s definitely a vendor’s market.

Recent data from the National Housing Finance and Investment Corporation shows a 115,000 dwelling undersupply for 2028.

- Interest Rates Continue to Rise

The biggest challenge for potential and current property owners? Interest rates. With interest rates continuing to rise, demonstrating an ability to service a loan remains one of the biggest challenges for prospective buyers to face.

Interest rates are high, but assessment levels are three percentage points higher again – making it even harder for buyers to enter the market or secure their dream property.

- Economic Uncertainty

In addition to rising interest rates, we’re also in the midst of a cost of living crisis where consumer confidence is low.

Should RBA cut interest rates, there’s a good change we would see a pick-up in both buyer and seller activity. It’s also highly likely that lower interest rates would be the catalyst for a further uptick in housing values, however, we’re not expecting a rate cut anytime soon and there’s speculation that rates may continue to rise this year.

Economists are split on their forecasts with predictions for further rate hikes, stability and some cuts later this year – all contributing to uncertainty and low consumer confidence levels.

- A Helping Hand

Government policies and regulations play a crucial role in shaping the property market. Policies related to taxation, lending practices, and housing affordability can have both direct and indirect effects on the market.

At the moment, first home buyers in particular have a wide variety of grants, concessions and schemes available to them (outlined in our First Home Buyer Update here) that could make purchasing a property easier and more affordable.

- Migration Predicted to Recover

With net overseas migration set to fully recover to pre-pandemic levels there will be more pressure on the housing market than we’ve seen in recent years.

With the return of international students and the surge in migration, it is estimated that an extra half a million people will be looking for somewhere to live in Australia in the next two years.

- Low vacancy rates bringing investors into the market

We are experiencing a rental crisis across the country, with historically low vacancy rates encouraging more investors into the market. Unfortunately for investors, rising interest rates and property prices have made this challenging – as well as rising building costs making it harder for investors and developers to buy and renovate or rebuild.

Is now the right time to buy or sell?

In short? Maybe. Unfortunately it’s not a one size fits all answer.

Ultimately, making an informed choice that aligns with your own circumstances and long term goals is key when navigating the property market.

Luckily, we’re here to help. We’ll sit down to work out what your goals are, what your property budget may be and how we can help you secure a property. Contact us today to get started!