Over time wear and tear will inevitably depreciate the value of your investment property. Depending on your circumstances, you may be eligible to offset the cost of wear and tear in deductions on your taxable income.

What is depreciation?

Property depreciation is the devaluation of a house and its contents over time due to wear and tear. Just like a car depreciates in value over time, a house and its fittings depreciate in value too. In Australia, property investors can claim this loss in value as a tax deduction.

What type of depreciating assets can be claimed?

There are two types of property depreciation assets, both of which can be claimed as tax deductions on your overall taxable income.

Depreciation on housing allowances refers to the construction costs of a new property, including bricks and concrete. Over time these assets will experience wear and tear and therefore depreciate in value. For example, if you have a new property with a price point of $650,000, 50% of the build is depreciable at 2.50%, which equates to more than $8,000 per year in tax deductions.

Depreciation on plant and equipment includes fittings within your house such as an oven, dishwasher, carpet and curtains. Depreciation on housing appliances like an oven and dishwasher can be calculated according to the ‘Effective Life’ of the asset. An item’s effective life is calculated from the time of purchase until the item can be sold at no more than scrap value.

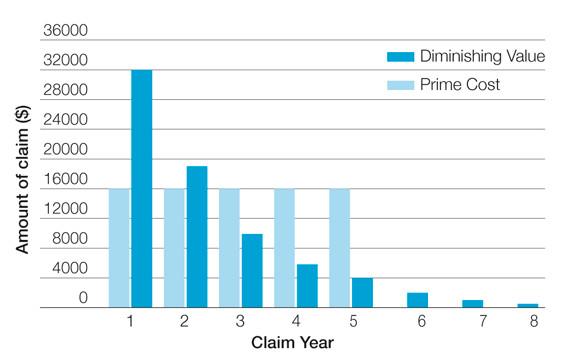

The depreciation of assets can be calculated by one of two methods, the prime cost method of depreciation or the diminishing value method. According to the ATO, once you have chosen a depreciation method for a particular asset, you cannot switch to the other method.

[Source: Australian Taxation Office]

Which properties are entitled to depreciation tax breaks?

Properties built from 18 July 1985 onwards are entitled to claim depreciation on housing allowances. Properties that were built prior to 1985 but have had structural improvements from 27 February 1992 onwards are also claimable for depreciation on housing allowances.

How is depreciation calculated?

In order to claim depreciating assets on your property, a report called a depreciation schedule needs to be put together and lodged to the ATO. A depreciation schedule will outline the value of your property’s assets, both housing allowances and plant and equipment, and calculate the rate of depreciation thereafter. A professional called a quantity surveyor is qualified by the ATO to calculate depreciating assets. Other professionals who are qualified to put together your depreciation schedule include a clerk of works, a builder who is experienced in estimating construction costs and a supervising architect who approves payments at each stage of a building project. In order to claim the maximum amount in deductions on your property, the best time to arrange a depreciation schedule is immediately after settlement and before tenants have moved in.

Why does understanding depreciation matter?

In order to maximise return on your property investment, it’s important to take a look at each financial facet of the investment, tax breaks included. Claiming depreciation on your property investment will reduce your overall taxable income and therefore improve cash flow, making it a financial opportunity to further grow your property portfolio. Some investors will even factor depreciation into their buying decisions. Investors may choose to purchase a property built after 1985 in order to claim the maximum amount of deductions on depreciation.

In Australia, there are several rules and exceptions involved with depreciation, therefore it’s important to speak to a professional to find out if your property is eligible.

If you would like to understand more about depreciation and how it can be factored into your investment strategy, contact me today on 02 9095 6888.